Monthy (October 2025) Performance of Nifty 50

In October, the Nifty 50 delivered a strong performance, advancing 1,111 points, or 4.51% for the month. The index successfully crossed the key resistance level of 25,686, which also marked the previous 52-week high.

From a technical perspective, the intermediate-term and long-term trends remain bullish, while the short-term trend is undergoing a corrective phase. The immediate support level now lies at 25,686. A breakdown below this level may lead the index to retest the 25,450 – 25,500 zone.

Table of Contents

Weekly Performance of Nifty 50

In the most recent week(27th to 31st October 2025), Nifty moved within a narrow range of 26,097 to 25,710, eventually closing with a mild loss of 73.05 points, or 0.28%.

Table 1 : Weekly Performance

| Particulars | Value |

|---|---|

| Open | 25,843.20 |

| High | 26097.85 |

| Low | 25711.20 |

| Close | 25,722.10 |

| Previous Close | 25,795.15 |

| Gain | -73.05 |

| Gain(%) | -0.28 |

Table 2 : Snapshot of Market Trends

| Time frame | Chart used | Trend Direction |

|---|---|---|

| Short Term | Daily | Down |

| Intermediate Term | Weekly | Up |

| Long Term | Monthly | Up |

Technical Analysis

Chart Source : Zerodha Kite

Chart Description

Candlestick Chart

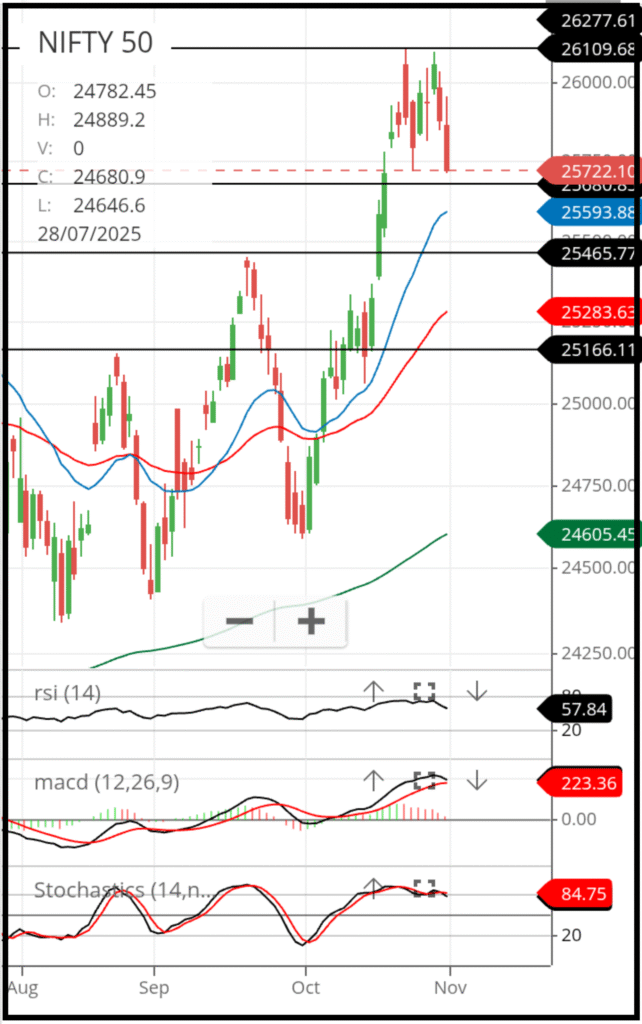

This is a daily candlestick chart of the Nifty 50 index.

Green Candles

Green candles show that the closing price is higher than the opening price.

Red Candles

Red candles indicate that the closing price is lower than the opening price.

Wicks

- The upper wick represents the highest price reached during the day.

- The lower wick represents the lowest price of the day.

Signals from the Candlestick Chart

A green candlestick signals a bullish move, while a red candlestick signals a bearish move. Candlestick analysis is a broad subject, but the basic idea is simple:

- More than two consecutive green candles suggest a bullish bias.

- More than two consecutive red candles suggest a bearish bias.

Exponential Moving Averages (EMA)

- The blue line represents the 20-day EMA.

- The red line represents the 50-day EMA.

- The green line represents the 200-day EMA.

EMA Signals

- When the price stays above the EMA, it indicates a bullish trend.

- When the price stays below the EMA, it signals a bearish trend.

- When a short-term EMA crosses above a long-term EMA, it implies a bullish trend.

- When a long-term EMA stays above a short-term EMA, it implies a bearish trend.

Support and Resistance

The black horizontal lines on the chart mark support and resistance zones.

How to Read Support and Resistance

- When the price trades above a horizontal line, that line acts as support.

- When the price trades below a horizontal line, it becomes resistance.

There is also a form of psychological support and resistance, which appears at round numbers ending in zero (for example: 500, 1000, 6000, 25000, etc.). These levels exist even if they are not shown visually on the chart.

- When the price breaks above a resistance level, it is considered a bullish signal.

- When the price drops below a support level, it is viewed as a bearish signal.

Trendlines

The black sloping straight lines on the chart represent trendlines.

Trendlines are drawn by connecting major highs or major lows.

- A major low is a point where price stayed at the lowest level for a significant period (such as 1 month, 3 months, 6 months, 1 year, or even 3–5 years).

- A major high is the opposite — the highest price for a long duration (same time ranges as above).

Interpreting Trendlines

- When the price moves above a trendline, the market shows a bullish signal.

- When the price falls below a trendline, it indicates a bearish signal.

Relative Strength Index (RSI-14)

The RSI uses three key levels:

- Level 50: Above 50 → bulls are in control, Below 50 → bears are in control.

- Below 30: Bears dominate, but price enters the oversold zone, increasing the chance of a short-term pullback.

- Above 70: Bears still dominate, but price enters the overbought zone, suggesting a possible short-term pullback.

Stochastics (9, 3, 3)

The Stochastic indicator contains two lines — one black and one red. The red line is not a signal line; it represents the slow stochastic, while the black line represents the fast stochastic.

Like RSI, this tool also works around three reference levels:

- Level 50: Above 50 → bulls are in control, Below 50 → bears are in control.

- Below 20: Bears dominate, but the price has entered the oversold region, meaning a short-term bounce is possible.

- Above 80: Bears dominate again, but price has reached the overbought region, suggesting a pullback may follow.

MACD (12, 26, 9)

The MACD contains two lines — black and red. The red line is the signal line, and the histogram is formed from the difference between the two lines.

MACD is a powerful indicator but tends to react late. It reflects intermediate-term trends on a short-term chart.

The zero line plays a crucial role:

- When MACD moves above the zero line, it signals that bears are losing strength and bulls are beginning to take control.

- When MACD drops below zero, the opposite scenario occurs.

- When the black line crosses above the red line, it suggests a strong bullish intermediate trend.

- When the black line crosses below the red line, it signals a strong bearish intermediate trend.

- More than two consecutive green histogram bars show growing bullish momentum.

- More than two consecutive red histogram bars show increasing bearish momentum.

Chart Inference:

Chart Pattern

Looking at the chart pattern, the Nifty 50 has been forming a sequence of higher highs. The first high was recorded on 21st August, followed by the second on 19th September, and the latest one on 23rd October. This suggests that the index is moving within an up-trending channel, clearly visible on the chart.

Because the channel is quite wide, any pullbacks are likely to be sharp. However, the same structure also signals that the broader bullish trend may continue for an extended period.

Support & Resistance Commentary

The Nifty 50 is currently positioned near multiple resistance levels, marked at 26,000, 26,100, and 26,277.

In the near term, the immediate resistance lies at 26,000. If the index successfully breaches 26100 on a closing basis, we may expect a further upward move toward the next resistance zone at 26,277.

Should the momentum continue and the index manage to sustain above 2600, the next potential upside target becomes 26500.

On the downside, the index has three key support levels placed at 25,686, 25,451, and 25,000.

If Nifty slips below the support at 25686, the next likely downside test would be the zone around 25,451.

A further breakdown below 25,451 may drag the index toward the deeper support at 25,000, which is expected to act as a stronger cushion unless a major trend reversal takes place.

Table 3 : Supports And Resistances

| Support 1 | 25,000 |

| Support 2 | 25,451 |

| Support 3 | 25,686 |

| Closing | 25,722.10 |

| Resistance 1 | 26,000 |

| Resistance 2 | 26,100 |

| Resistance 3 | 26,277 |

Interpretation of EMAs (20, 50, 200)

The price is currently above the 20 EMA, indicating a short-term bullish trend.

The price is currently above the 50 EMA, indicating an intermediate-term bullish trend.

The price is currently above/below the 200 EMA, indicating a long-term bullish trend.

Additionally, the 20 EMA is above the 50 EMA, which confirms a bullish intermediate trend.

The 50 EMA is above the 200 EMA, which confirms a bullish long-term trend.

When all three EMAs are aligned in the same direction (20 > 50 > 200 for bulls or 20 < 50 < 200 for bears), it strengthens the trend and reduces the probability of false signals.

Table 4 : Exponential Moving Averages (EMAs)

| EMA | Value | Comments | Inference |

|---|---|---|---|

| EMA – 10 | 25,784 | Higher than Close | Sell |

| EMA – 20 | 25,593 | Lower than Close | Buy |

| EMA – 50 | 25,283 | Lower than Close | Buy |

| EMA – 200 | 24,494 | Lower than Close | Buy |

Interpretation of RSI (14)

The current RSI (14) value is 57.84. Since the RSI is above the 50-level threshold, market momentum currently favors the bulls.

The indicator is in the bullish zone with negative divergence, which suggests a potential short-term pullback.Traders should exercise caution and avoid initiating aggressive short positions at this stage. Instead, the preferred strategy is to buy on dips until the indicator cools off and confirms a clearer trend reversal.

Interpretation of Stochastics

The current Stochastics (14) value is 85. Since the Stochastics is above the 50-level threshold, market momentum currently favors the bulls.

The indicator is in the overbought zone, which suggests a potential short-term pullback. Traders should exercise caution and avoid initiating aggressive short positions at this stage. Instead, the preferred strategy is to buy on dips until the indicator cools off and confirms a clearer trend reversal.

Interpretation of MACD

The MACD value is currently 233 which is above the zero line. This indicates that the market is presently under the control of the bulls.

Additionally, the MACD line (black) is above the signal line (red), which further confirms a bullish momentum shift. But MACD is showing negative divergence and it is moving towards its signal line indicating a short downward rally. As long as this crossover remains intact, the prevailing trend is expected to continue in the favour of bulls.

However, the MACD line has begun to converge toward the signal line, traders should be alert for a possible reversal or loss of momentum. A confirmed crossover in the opposite direction would signal a fresh buying opportunity.

Table 5 : Indicators

| Indicator | Value | Comments | Inference |

|---|---|---|---|

| RSI | 57.84 | Negative divergence above level 50 | Sell |

| Stochastics | 84.50 | Over Bought | Sell |

| MACD | 233 | Negative Divergence | Sell |

Technical Outlook:

Overall technical bias and expected price action

Table 6 : Overall Technical Summary

| Object | Comments | Final Verdict |

|---|---|---|

| Trendline | Uptrending | Buy |

| EMAs | Short term sell weak Long term Strong | Buy on Dips |

| RSI | Negative Divergence | Sell |

| Stochastics | Over bought | Sell |

| MACD | Moving towards Signal line | Sell |

| Overall Outlook | Short term trend is Weak but long term trend is strong | Short term trend is bearish but may reverse after meaningful Correction |

Conclusion:

Tips for Active Traders:

Traders are advised to stay cautious with short positions. Although the short-term trend is currently bearish, it could reverse at any time, as there is no weakness visible in the intermediate or long-term trend.

Frequently Asked Questions (FAQ)

Q1: What is your view of Nifty 50 for the upcoming week?

Nifty 50 is expected to remain bullish with a short term correction based on current price action and market structure.

Q2: Is Nifty 50 likely to continue its trend or face a reversal?

The index is showing signs of trend continuation as per chart pattern and moving averages.

Q3: What are the key support levels for Nifty 50?

Immediate support is placed near 25,686, followed by a stronger support zone around 25,451.

Q4: What are the major resistance levels for Nifty 50?

The first resistance lies near 26000 while the next supply zone is around 26100

Q5: Which indicators are currently supporting the trend?

EMAs are currently indicating bullish sentiment.

Q6: What should traders be cautious about next week?

Traders should watch out for global cues ,economic data , political events, as it may trigger short-term correction or a sharp move

Disclaimer

This analysis is strictly for educational and informational purposes only. It should not be considered as financial advice or a recommendation to buy, sell, or hold any securities.

All charts and market data used in this post are sourced from third-party platforms. I do not own or control these charting tools, and the accuracy or completeness of their data cannot be guaranteed.

I am not a SEBI-registered analyst or investment advisor. Any decision taken by the reader based on this content is entirely at their own risk.

No responsibility is taken for the claims or offerings of any advertisements that may appear alongside this content. Viewers are advised to verify all external claims independently.